PFAS-Free Food Packaging Market Drives USD 84.96 Bn by 2034 | Towards Packaging

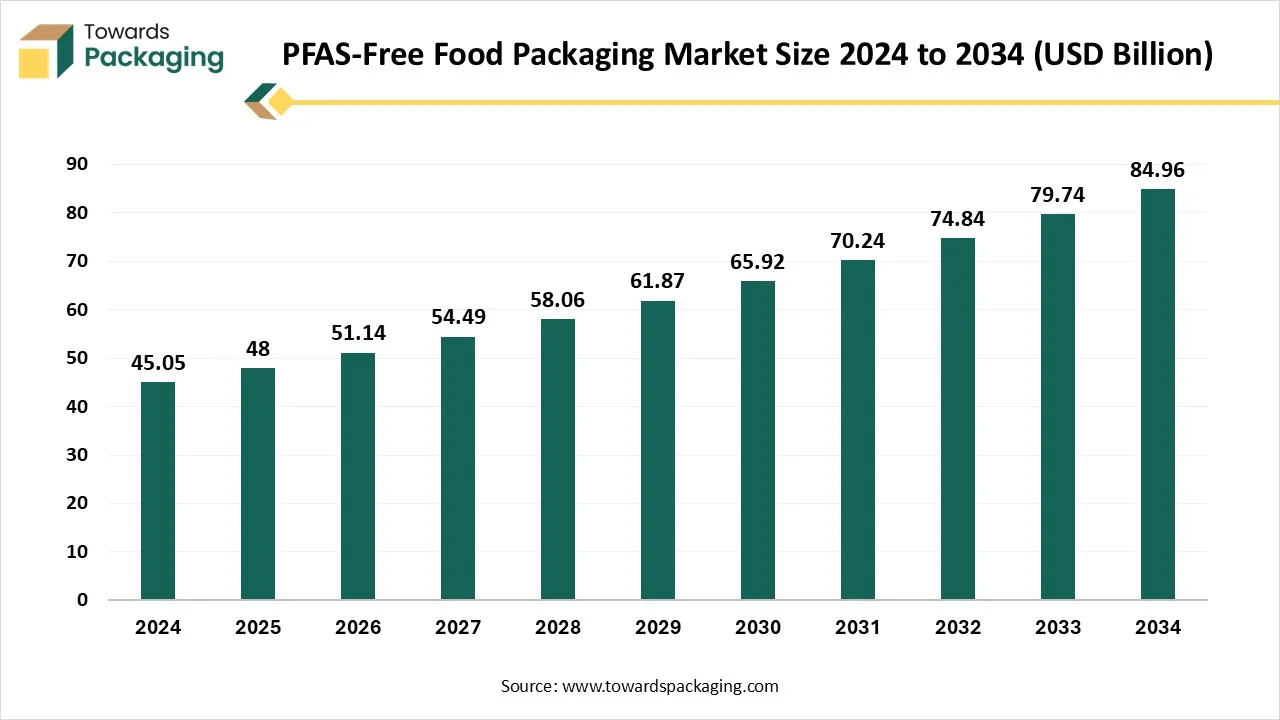

According to Towards Packaging, the global PFAS-free food packaging market will grow from USD 48 billion in 2025 to USD 84.96 billion by 2034, with an expected CAGR of 6.55%.

Ottawa, Sept. 01, 2025 (GLOBE NEWSWIRE) -- The PFAS-free food packaging market size surpassed USD 45.05 billion in 2024 and is estimated to hit around USD 84.96 billion by 2034, growing at a CAGR of 6.55% from 2025 to 2034. A study published by Towards Packaging a sister firm of Precedence Research.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5666

The market is expanding rapidly due to increasing consumer awareness and regulatory pressure to eliminate harmful per- and polyfluoroalkyl substances (PFAS) from food contact materials. Rising health and environmental concerns associated with PFAS exposure are driving manufacturers to adopt safer alternatives, such as biodegradable coatings and natural barrier materials.

The growth of food delivery and e-commerce has further accelerated demand for PFAS-free packaging that ensures food safety and sustainability. Innovations in compostable and recyclable materials, coupled with stringent government regulations across North America and Europe, are positioning PFAS-free packaging as a key solution in modern, eco-conscious food packaging strategies.

What is Meant by PFAS-Free Food Packaging?

PFAS-free food packaging refers to food packaging materials that are manufactured without per- and polyfluoroalkyl substances (PFAS), a group of synthetic chemicals used for their water-, grease-, and stain-resistant properties. PFAS are persistent in the environment and have been linked to health concerns such as hormonal disruption, liver damage, and certain cancers.

PFAS-free packaging uses alternative materials or coatings that provide similar grease- and moisture-resistant functionality without the harmful chemicals. These alternatives can include biodegradable coatings, plant-based waxes, and other eco-friendly barriers, making the packaging safer for both consumers and the environment while meeting food safety and sustainability requirements.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What are the Latest Trends in the PFAS-Free Food Packaging Market?

Shift to Sustainable Materials

Manufacturers are adopting biodegradable and compostable materials, such as plant-based coatings and seaweed-derived films, to replace traditional PFAS-laden packaging. For instance, companies like Notpla are developing seaweed-based packaging solutionsv that are both biodegradable and free from harmful chemicals.

Advancements in Barrier Coatings

Innovations in water-based and graphene oxide coatings are providing effective alternatives to PFAS, offering similar protective qualities without the associated health risks. Graphene oxide coatings, for example, have been developed as non-toxic, compostable substitutes for PFAS in food packaging.

Regulatory Pressures

Governments worldwide are implementing stricter regulations to limit PFAS usage in food packaging. In the United States, several states have enacted laws restricting PFAS in food containers, prompting manufacturers to seek safer alternatives.

Consumer Awareness

There is a growing consumer preference for products with transparent and eco-friendly packaging. Brands are responding by adopting PFAS-free packaging solutions to meet consumer expectations and enhance brand loyalty.

What Potentiates the Growth of the PFAS-Free Food Packaging Market?

Health and Safety Concerns & Consumer Preference for Sustainable Packaging

Rising awareness of the harmful effects of PFAS, which are linked to cancer, hormonal disruption, and other health issues, is pushing both consumers and manufacturers toward safer alternatives. Eco-conscious consumers increasingly demand packaging that is safe, biodegradable, and environmentally friendly, boosting PFAS-free solutions. The expansion of consumer preference for sustainable packaging is a major growth driver for the PFAS-free food packaging market.

Modern consumers are increasingly eco-conscious and health-aware, seeking products packaged in materials that are safe, biodegradable, and environmentally friendly. This shift in behaviour encourages food and beverage companies to adopt PFAS-free alternatives, which avoid harmful chemicals while offering compostable or recyclable options. Brands that provide sustainable packaging can enhance their reputation, gain consumer trust, and differentiate themselves in competitive markets.

More Insights of Towards Packaging:

- Chemical Repackaging Market Insights 2025: JPFL Launches India’s First BOPA Nylon Films, Boosting Aroma Barrier Packaging - The chemical repackaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Agriculture Chemical Packaging Market: Driving Sustainability with Smart, Secure Solutions - The agriculture chemical packaging market is expected to increase from USD 4.91 billion in 2025 to USD 7.39 billion by 2034.

- Chemical Packaging Material Market Insights, Forecast and Competitive Strategies - The chemical packaging material market is on a strong growth trajectory, with revenue expected to surge into the hundreds of millions from 2025 to 2034.

- Chemicals Packaging Coding Equipment Market Strategic Insights for 2034 - The chemicals packaging coding equipment market is forecast to grow from USD 1.22 billion in 2025 to USD 1.53 billion by 2034.

- Daily Chemical Product Stand Up Pouches Market Strategic Growth, Innovation & Investment Trends - The daily chemical product stand up pouches market size reached US$ 241.16 million in 2024 and is projected to hit around US$ 387.24 million by 2034.

- Pharmaceutical and Chemical Aluminum Bottles and Cans Market Strategic Insights for 2034 - The pharmaceutical and chemical aluminum bottles and cans market is anticipated to grow from USD 2368.51 million in 2025 to USD 2477.25 million by 2034.

- Chemicals Packaging Market Key Business Drivers & Industry Forecast - The chemicals packaging market is expected to increase from USD 16.56 billion in 2025 to USD 22.79 billion by 2034.

- Cling Films Market Size Driven by 12.5% CAGR (2025-2034) - The global cling films market is forecast to grow from USD 13.06 billion in 2025 to USD 19.41 billion by 2034.

- Industrial Bulk Packaging Market Size Driven by 3.25% (2025-34) - The global industrial bulk packaging market is projected to reach USD 37.86 billion by 2034, expanding from USD 28.39 billion in 2025.

- North America Packaging Market Size Drives at 4.33% CAGR - The North America packaging market is forecasted to expand from USD 333.86 billion in 2025 to USD 488.92 billion by 2034.

Limitations & Challenges in the PFAS-Free Food Packaging Market

Limited Material Performance & Supply Chain Constraints

The key players operating in the market are facing issues due to supply chain constraints and limited material performance. Some PFAS-free materials may not yet match the water-, grease-, and oil-resistant properties of PFAS-based packaging, which can limit their adoption, especially for high-demand food products. The availability of sustainable and PFAS-free raw materials can be limited, leading to production bottlenecks and slower market penetration.

Regional Analysis:

Who is the leader in the PFAS-Free Food Packaging Market?

North America dominates the PFAS-free food packaging market due to a combination of stringent regulations, high consumer awareness, and strong industry adoption. Regulatory frameworks in the U.S. and Canada, such as state-level PFAS bans in food contact materials, have compelled manufacturers to shift toward safer alternatives.

Additionally, consumers in North America are increasingly demanding environmentally friendly and chemical-free packaging, motivating brands to adopt PFAS-free solutions. Technological advancements and investments in sustainable materials, along with the presence of major food and beverage companies prioritizing health and safety, further strengthen the region’s leadership in the market.

U.S. Market Trends

The U.S. leads the market due to strict state-level regulations, such as California’s Safer Consumer Products program and New York’s bans on PFAS in paper-based food packaging, which compel manufacturers to adopt safer alternatives. Rising consumer awareness of the health risks associated with PFAS has further accelerated demand for chemical-free packaging solutions. Food and beverage companies are increasingly prioritizing PFAS-free materials to comply with regulations, maintain brand reputation, and meet consumer expectations, positioning the U.S. as a dominant player in this market.

Canada Market Trends

In Canada, regulators have recognized the risks of PFAS in food packaging and are exploring risk management and potential regulatory measures. Although comprehensive bans are not yet in place, growing consumer demand for sustainable and chemical-free packaging is encouraging manufacturers to adopt PFAS-free alternatives. Canadian companies are proactively shifting toward safer packaging to align with environmental concerns and anticipate future regulations, which is steadily driving market growth and positioning Canada as a significant adopter in the PFAS-free food packaging segment.

How is the Opportunistic Rise of the Asia Pacific in the PFAS-Free Food Packaging Market?

Asia-Pacific is witnessing the fastest growth in the PFAS-free food packaging market due to increasing consumer awareness about health and environmental impacts, rapid urbanization, and the rising demand for sustainable and safe packaging in the food and beverage sector.

Governments in countries such as China, Japan, and South Korea are implementing stricter regulations and guidelines to reduce harmful chemicals in packaging, prompting manufacturers to shift toward PFAS-free alternatives. Additionally, the expansion of e-commerce and food delivery services in the region is driving demand for eco-friendly packaging solutions, further accelerating market growth and adoption of PFAS-free materials.

China Market Trends

China’s market is growing rapidly due to increasing consumer demand for safer and sustainable packaging solutions, along with stricter environmental regulations. Manufacturers are adopting PFAS-free materials to comply with domestic and international standards. The government’s focus on environmental sustainability further drives the shift toward safer packaging alternatives, encouraging innovation and adoption of chemical-free materials across the food and beverage sector.

Japan Market Trends

Japan leads in PFAS-free food packaging adoption, driven by stringent regulations and strong consumer preference for environmentally friendly products. Policies aimed at reducing harmful chemicals in packaging are motivating manufacturers to explore safer alternatives. Increasing public awareness of health and environmental concerns is accelerating the transition to PFAS-free solutions across the food industry.

India Market Trends

In India, the PFAS-free food packaging market is gradually expanding as consumers become more aware of health and environmental issues. Although regulations are still developing, manufacturers are exploring PFAS-free alternatives to meet global sustainability trends and growing demand in organized retail and foodservice sectors.

South Korea Market Trends

South Korea is witnessing significant growth due to strict environmental regulations and a strong focus on sustainability. Government policies reducing hazardous substances in packaging, coupled with rising consumer demand for eco-friendly products, are driving manufacturers to adopt PFAS-free packaging solutions and innovate in this segment.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

How Big is the Success of the North America PFAS-Free Food Packaging Market?

Europe is growing at a notable rate in the market due to stringent environmental regulations, increasing consumer awareness of health and sustainability, and the strong push toward eco-friendly packaging solutions. Governments and regulatory bodies across countries such as Germany, France, and the UK have implemented policies to restrict harmful chemicals in food packaging, compelling manufacturers to adopt safer alternatives.

Additionally, the growing preference for organic and clean-label products is driving demand for PFAS-free packaging. The presence of innovative packaging companies and rising investments in sustainable packaging technologies further support market expansion across Europe.

How Crucial is the Role of Latin America in the PFAS-Free Food Packaging Market?

Latin America is experiencing considerable growth in the PFAS-free food packaging market due to increasing consumer awareness of health and environmental issues, coupled with growing demand for safe and sustainable packaging solutions in the food and beverage sector. Governments in countries like Brazil, Mexico, and Argentina are beginning to implement regulations and guidelines that encourage the reduction of harmful chemicals in food contact materials.

Additionally, the expansion of modern retail, e-commerce, and food delivery services is driving the adoption of PFAS-free packaging. Rising investments in sustainable materials and innovative packaging technologies further support market growth in the region.

How does the Middle East and Africa lead the PFAS-Free Food Packaging Market?

The Middle East and Africa (MEA) offers significant growth potential for the market due to a combination of regulatory initiatives, rising consumer awareness, and sustainability trends. Countries such as the UAE and Saudi Arabia are implementing stricter food safety and packaging regulations, encouraging manufacturers to adopt safer, PFAS-free alternatives.

Increasing public awareness about the health risks associated with PFAS compounds is further driving demand for chemical-free packaging. Additionally, the growing emphasis on eco-friendly solutions and the expansion of modern retail and foodservice sectors are promoting the adoption of innovative and compliant PFAS-free packaging solutions across the region.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Packaging Type Insights

The wraps and liners segment dominates the PFAS-free food packaging market due to its widespread use in quick-service restaurants, bakeries, and food delivery services, where grease and moisture resistance are critical. With growing concerns over the harmful effects of PFAS chemicals, foodservice providers are increasingly shifting toward PFAS-free wraps and liners that ensure safety while maintaining functionality.

Consumer demand for healthier, non-toxic packaging solutions has further boosted adoption. Additionally, the rising popularity of takeaway and ready-to-eat meals has significantly increased the use of sustainable wraps and liners, making this segment the most widely adopted in PFAS-free food packaging.

The clamshells and hinged container segment is the fastest-growing in the market due to the rapid rise of takeaway, delivery, and on-the-go food consumption. These containers are widely used for hot, greasy, or moist foods, which previously relied on PFAS-coated packaging for durability and resistance. With growing bans and restrictions on PFAS, foodservice providers are increasingly adopting safer alternatives that offer similar performance without harmful chemicals. The push for eco-friendly, compostable, and recyclable options also supports this growth, as consumers and businesses prefer sustainable packaging solutions that align with health and environmental priorities.

Material Type Insights

The paper and paperboard segment dominates the PFAS-free food packaging market because of its versatility, cost-effectiveness, and eco-friendly nature. With increasing bans on PFAS chemicals in food packaging, paper-based alternatives have emerged as the preferred choice for manufacturers and foodservice providers. They are widely used for wraps, cartons, trays, and liners due to their biodegradability and recyclability, aligning with global sustainability goals.

Advances in barrier coatings and water-based technologies have improved the grease and moisture resistance of paper packaging, making it a strong replacement for PFAS-treated materials. Rising consumer demand for safe, non-toxic, and sustainable packaging further reinforces the dominance of this segment.

The bioplastic segment is the fastest-growing in the market due to its strong alignment with sustainability trends and rising demand for eco-friendly alternatives. Unlike traditional plastics, bioplastics are derived from renewable sources such as corn starch, sugarcane, and cellulose, making them attractive to both consumers and regulators seeking to reduce environmental impact. They offer durability, flexibility, and improved barrier properties without relying on harmful PFAS chemicals.

Growing investments in biopolymer innovation, along with increasing adoption by foodservice chains and packaging manufacturers, further accelerate growth. Additionally, consumer preference for compostable and biodegradable packaging fuels the rapid expansion of this segment.

End-Use Sector Insights

The quick-service restaurants segment dominates the PFAS-free food packaging market due to its high consumption of disposable packaging and strong pressure to adopt sustainable alternatives. With increasing regulations banning PFAS in food contact materials, QSRs are rapidly shifting to safer, eco-friendly options to maintain compliance and protect brand reputation.

Major chains are adopting PFAS-free wraps, liners, clamshells, and cups to meet consumer expectations for health and environmental safety. The segment’s dominance is further reinforced by the large volume of daily transactions, where sustainable packaging directly impacts waste reduction. Growing customer preference for greener dining solutions strengthens QSRs’ leadership in this market.

The retail and supermarkets segment is the fastest-growing in the market, as these outlets play a central role in directly influencing consumer choices. With rising consumer awareness about the health risks of PFAS and increasing demand for safer, eco-friendly packaging, supermarkets are under pressure to offer sustainable alternatives across fresh produce, bakery, frozen, and ready-to-eat categories.

Many leading retailers are introducing PFAS-free packaging lines to align with corporate sustainability goals and comply with tightening regulations. The segment’s rapid growth is also supported by the high turnover of packaged goods and private-label brands, where eco-friendly packaging becomes a key differentiator to attract environmentally conscious shoppers.

Access our exclusive, data-rich dashboard dedicated to the PFAS-Free Food Packaging Market built specifically for decision-makers, strategists, and industry leaders. This interactive platform provides comprehensive statistical insights, segment-wise market breakdowns, regional performance analysis, detailed company profiles, annual updates, and much more. From market sizing and growth projections to competitive intelligence and regulatory trends, our dashboard serves as a one-stop solution to empower smarter decisions in the fast-evolving sustainable packaging industry.

Access Now: https://www.towardspackaging.com/contact-us

Recent Breakthroughs in the Global Market

- In June 2025, Lecta Self-Adhesives announced the launch of "Adestor Gloss GP PFAS-free," a new label solution designed specifically for the food packaging sector, which will broaden its portfolio of self-adhesive materials. Without the use of perfluoroalkyl substances (PFAS), this product offers a grease-resistant label while adhering to strict environmental and health regulations. Adestor Gloss GP PFAS-free is made from paper that has been certified by the Forest Stewardship Council (FSC) C011032, guaranteeing excellent performance and grease and oil resistance.

- In April 2024, Kao Corporation wants to realize resource circularity in society by achieving net-zero waste in plastic packaging by 2040 and negative waste by 2050 for plastic containers used and discharged in its business operations. The company plans to achieve this by first using as little plastic packaging as possible in its operations and then recycling plastic waste produced by society to produce goods and services that are beneficial. Kao launched the Kirei Lifestyle Plan, its ESG strategy, in April 2019. This strategy supports the zero-waste leadership action, one of the 19 leadership actions outlined in this plan.

Global PFAS-Free Food Packaging Market Players

- Huhtamaki

- Footprint

- Georgia-Pacific

- Stora Enso

- Vegware

- Sabert Corporation

- Novolex (Eco-Products)

- Biopak

- Genpak

- Duni Group

Global PFAS-Free Food Packaging Market Segments

By Packaging Type

- Plates, Bowls, and Trays

- Molded fiber trays

- Sugarcane bagasse plates

- Cups and Lids

- Paper cups with PLA/aqueous lining

- Compostable biopolymer lids

- Clamshells and Hinged Containers

- Kraft paper-based

- Plant-based plastics (e.g., PLA, PHA)

- Wraps and Liners

- Grease-resistant paper (non-fluorinated coatings)

- Wax-based or clay-coated paper

- Bags and Pouches

- Bakery bags

- Sandwich wraps Shape, Picture

By Material Type

- Molded Fiber and Pulp

- Bagasse (sugarcane fiber)

- Wheat straw

- Bamboo

- Paper and Paperboard (PFAS-free coated)

- Aqueous-coated

- Biopolymer-coated (e.g., PLA, CMC)

- Bioplastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- PBAT blends

- Cellulose-based Films

- Regenerated cellulose

- Coated kraft films

- Others

- Clay-coated substrates

- Bio-waxes Shape, Picture

By End-Use Sector

- Quick-Service Restaurants (QSR)

- Burger wrappers, fry sleeves, clamshells

- Retail and Supermarkets

- Bakery trays, meat pads, frozen food wraps

- Cafés and Beverage Chains

- Cups, cup sleeves, lids

- Institutional Catering

- Trays, wraps

- Others

- Airlines, events, schools

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5666

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.